Traders are probably the next people AI will replace.

Not artists, not copywriters, not even the guy doing mid tweets for memecoins. Traders.

Some of you might remember online poker before it died. It started as some guys with RedBull and insomnia sitting playing tables in 2005.

Then the bots became a thing. They showed up at 3am, never tired, folding perfectly, taking everyone's money one small blind at a time. Mathematically correct, they turned poker into another kind of competition with much less reward for casual players.

Crypto-markets are about to go the same way. (Well, they kinda already are)

And we are not talking about grid traders on Binance kinda bots.

We are talking about full economic agents: that read, look for information, settle positions by themselves.

The market will slowly drive from humans with simple tools to agents with simple humans on top.

And the question isn't "will agents trade?"

Of course they will, the question is: When agents will trade and pay on-chain by themselves, which ones do you use and trust?

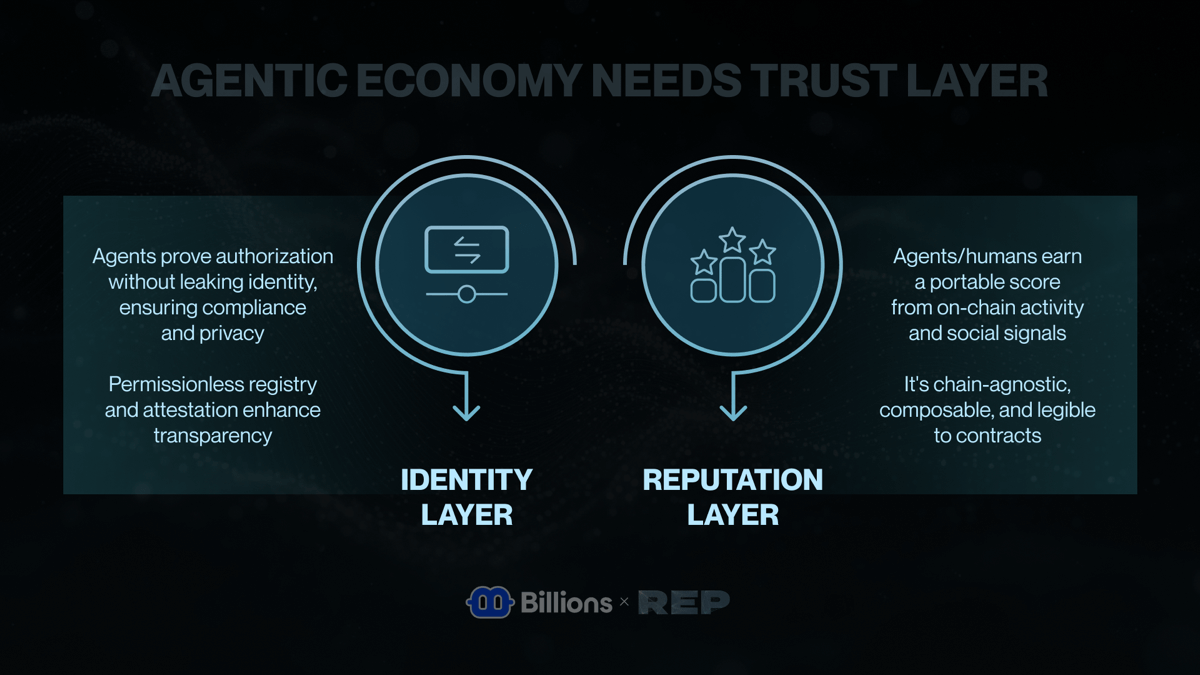

That's the problem REP and Billions aim to solve. Billions answers who is this agent actually tied to? REP answers how has this thing behaved across chains and time?

Some of you might remember online poker before it died. It started as some guys with RedBull and insomnia sitting playing tables in 2005.

Then the bots became a thing. They showed up at 3am, never tired, folding perfectly, taking everyone's money one small blind at a time. Mathematically correct, they turned poker into another kind of competition with much less reward for casual players.

Crypto-markets are about to go the same way. (Well, they kinda already are)

And we are not talking about grid traders on Binance kinda bots.

We are talking about full economic agents: that read, look for information, settle positions by themselves.

The market will slowly drive from humans with simple tools to agents with simple humans on top.

And the question isn't "will agents trade?"

Of course they will, the question is: When agents will trade and pay on-chain by themselves, which ones do you use and trust?

That's the problem REP and Billions aim to solve. Billions answers who is this agent actually tied to? REP answers how has this thing behaved across chains and time?

Credential Spread, KYA, REP and Billions

As soon as bots can pay, start trading, start farming, you immediately get the question:

"Now that agents are everywhere, who the hell are they?"

We spent a decade doing KYC for humans. Now we're heading into KYA, Know Your Agent.

Who created this agent? What are its spending limits? Is it allowed to act for a DAO, a company, a fund? Who is liable when it rugs? If I'm an exchange or a lending protocol, do I really want completely anonymous, unauthenticated agents spamming my endpoints with 402 requests and quotes?

If the answer is "no", you need a way to say:

"Now that agents are everywhere, who the hell are they?"

We spent a decade doing KYC for humans. Now we're heading into KYA, Know Your Agent.

Who created this agent? What are its spending limits? Is it allowed to act for a DAO, a company, a fund? Who is liable when it rugs? If I'm an exchange or a lending protocol, do I really want completely anonymous, unauthenticated agents spamming my endpoints with 402 requests and quotes?

If the answer is "no", you need a way to say:

- this agent is authorized by someone real

- this agent has a track record you can measure

- this agent can prove both facts without leaking all the underlying data.

Billions is trying to make agents into real, accountable entities.

An agent can prove "I'm authorized by this human / org / wallet" without doxxing who exactly, using zero-knowledge proofs. That's enough for compliance (someone is behind this), for infra (someone is allowed to spend here), and for orgs (this bot is in the budget, this one isn't).

On top of that, Billions maintains registries of these agents and their attestations. Not a private database, but something you can query on-chain: this agent exists, it's tied to this domain (trading, research, operations), it has these proofs attached.

Not all agents are equal. Billions is a way to encode that into something other systems can actually read. But identity alone doesn't answer the "is this thing sane?" question.

Just because a bot is authorized by a real human doesn't mean it isn't garbage. You still need a way to ask: how has this thing behaved historically? Has it rugged counterparties? Has it blown up? Has it actually done what it was supposed to do?

That's REP's part of the equation. REP treats agents (and humans behind them) as entities with a reputation trail.

It looks at on-chain behavior, usage patterns, social and graph signals, and turns that into portable scores you can actually feed to contracts. It's not glued to any single app or chain. The whole point is: your reputation follows you around.

Once you have that, simple rules start to work:

"only agents with REP above X can touch this order flow"

"agents above Y can borrow under deferred 402 settlement instead of prepaying"

"below Z you're rate-limited and pay rack rate for everything"

You don't have to know who's sitting behind the keyboard. You just need to know that this agent, with these credentials, has behaved reliably across enough interactions to justify giving it better terms than the random farm spinning up fresh wallets.

Billions says "this isn't just a random script, it's an agent authorized by someone real".

REP says "and based on its behavior, here's how much we trust it".

Together that's enough to start putting trust into your pricing function instead of into a support inbox.

An agent can prove "I'm authorized by this human / org / wallet" without doxxing who exactly, using zero-knowledge proofs. That's enough for compliance (someone is behind this), for infra (someone is allowed to spend here), and for orgs (this bot is in the budget, this one isn't).

On top of that, Billions maintains registries of these agents and their attestations. Not a private database, but something you can query on-chain: this agent exists, it's tied to this domain (trading, research, operations), it has these proofs attached.

Not all agents are equal. Billions is a way to encode that into something other systems can actually read. But identity alone doesn't answer the "is this thing sane?" question.

Just because a bot is authorized by a real human doesn't mean it isn't garbage. You still need a way to ask: how has this thing behaved historically? Has it rugged counterparties? Has it blown up? Has it actually done what it was supposed to do?

That's REP's part of the equation. REP treats agents (and humans behind them) as entities with a reputation trail.

It looks at on-chain behavior, usage patterns, social and graph signals, and turns that into portable scores you can actually feed to contracts. It's not glued to any single app or chain. The whole point is: your reputation follows you around.

Once you have that, simple rules start to work:

"only agents with REP above X can touch this order flow"

"agents above Y can borrow under deferred 402 settlement instead of prepaying"

"below Z you're rate-limited and pay rack rate for everything"

You don't have to know who's sitting behind the keyboard. You just need to know that this agent, with these credentials, has behaved reliably across enough interactions to justify giving it better terms than the random farm spinning up fresh wallets.

Billions says "this isn't just a random script, it's an agent authorized by someone real".

REP says "and based on its behavior, here's how much we trust it".

Together that's enough to start putting trust into your pricing function instead of into a support inbox.

What This Means for Markets (and for You)

Obviously, markets don't move in straight lines and none of this is guaranteed.

Maybe agentic and 402x adoption stalls because devs stay in Stripe-land and don't bother. Maybe everyone rolls their own "agent identity standard" and trust gets trapped in silos. Maybe attackers get good at farming "good behavior" so quickly that they compress the Credential Spread and nuke the trust layers.

REP and Billions don't magically fix any of that. They're just trying to give the ecosystem a shared language for two things we know will matter: who is this agent tied to; and how has it behaved.

If the agentic economy actually happens at scale, those are the first two questions everyone will be asking anyway.

Humans won't stop trading.

But the shape of the job changes from "sit 12 hours a day in front of a heatmap" to "design, deploy and risk-manage a fleet of agents".

Billions gives them cryptographic identity and authorization.

REP gives them a track record the market can actually price.

Put together, it's a sketch of markets where: agents are first-class citizens, every interaction is gated by some version of "who are you + how do you behave", and humans sit one layer up, deciding what to build and which agents to unleash on the world.

The people who get this early won't be "replaced by AI". They'll be the ones deploying it, deciding which of their bots get the good lane and which ones are just another set of bags waiting to be dumped on.

Everyone else can keep pretending we're still in 2021 and all you need is another monitor and more caffeine.

We've already seen how that story ends when the bots quietly sit at the same table as humans.

Spoiler: the bots don't get tired.

Maybe agentic and 402x adoption stalls because devs stay in Stripe-land and don't bother. Maybe everyone rolls their own "agent identity standard" and trust gets trapped in silos. Maybe attackers get good at farming "good behavior" so quickly that they compress the Credential Spread and nuke the trust layers.

REP and Billions don't magically fix any of that. They're just trying to give the ecosystem a shared language for two things we know will matter: who is this agent tied to; and how has it behaved.

If the agentic economy actually happens at scale, those are the first two questions everyone will be asking anyway.

Humans won't stop trading.

But the shape of the job changes from "sit 12 hours a day in front of a heatmap" to "design, deploy and risk-manage a fleet of agents".

Billions gives them cryptographic identity and authorization.

REP gives them a track record the market can actually price.

Put together, it's a sketch of markets where: agents are first-class citizens, every interaction is gated by some version of "who are you + how do you behave", and humans sit one layer up, deciding what to build and which agents to unleash on the world.

The people who get this early won't be "replaced by AI". They'll be the ones deploying it, deciding which of their bots get the good lane and which ones are just another set of bags waiting to be dumped on.

Everyone else can keep pretending we're still in 2021 and all you need is another monitor and more caffeine.

We've already seen how that story ends when the bots quietly sit at the same table as humans.

Spoiler: the bots don't get tired.